Investors who have worked with Betsy Lou Whipple, a seasoned financial advisor currently with Osaic Wealth, Inc., may have cause for concern. Recent reports and public disclosures indicate a troubling pattern of customer disputes and allegations of misconduct that could impact the security of your retirement savings and investment portfolios.

If you or someone you know has suffered significant investment losses working with Betsy Lou Whipple, Osaic Wealth, or her former firm Newbridge Securities, don’t hesitate to reach out to Meyer Wilson Werning today. Our attorneys are experienced in securities fraud cases and will help to guide you through the process with a free consultation to determine whether your losses are the result of actionable misconduct.

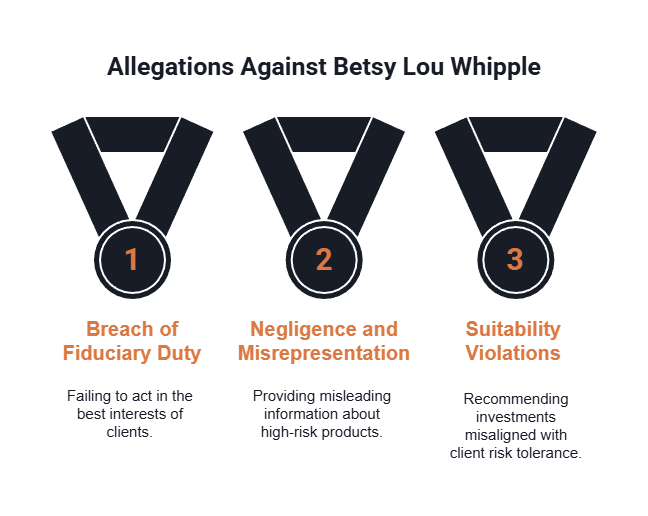

What Are the Allegations Against Betsy Lou Whipple?

Betsy Lou Whipple has spent nearly three decades in the financial industry, having worked at 15 different firms during her career. While long-standing experience is often seen as a benefit, her public record reveals nine client complaints (disclosures), with a significant surge in activity between 2024 and 2025.

Many of these complaints center on her time at Newbridge Securities Corporation, where she was registered from 2018 to 2024. The allegations include:

- Breach of Fiduciary Duty: Failing to act in the best interests of her clients.

- Negligence and Misrepresentation: Providing misleading information regarding the safety or potential returns of high-risk products.

- Suitability Violations: Recommending investments that did not align with a client’s risk tolerance or financial goals.

- Regulation Best Interest (Reg BI) Violations: Failing to adhere to the federal standard that requires brokers to prioritize client interests over firm profits.

We Have Recovered Over

$350 Million for Our Clients Nationwide.

The Risk of Alternative Investments and GWG L Bonds

A recurring theme in the disputes involving Whipple is the recommendation of complex “alternative” investments. Specifically, several claims are tied to GWG L Bonds, which were high-yield, illiquid junk bonds backed by life settlements.

Many investors—including retirees seeking safe, income-producing products—allegedly believed these bonds were secure. However, GWG Holdings, Inc. filed for Chapter 11 bankruptcy in April 2022, leaving thousands of bondholders with virtually worthless investments. Allegations suggest that Whipple misrepresented these as guaranteed or low-risk, omitting the fact that they were speculative and difficult to sell on a secondary market.

Understanding Brokerage Firm Responsibility and Supervision

Under industry regulations, brokerage firms like Osaic Wealth, Inc. and Newbridge Securities Corporation have a non-negotiable duty to supervise their registered representatives. When a firm fails to implement adequate oversight, it can be held liable for the financial harm caused by its advisors.

Betsy Lou Whipple (CRD# 2703262) is currently licensed in 18 states and operates out of Nevada. Her extensive history of firm-hopping and the density of recent complaints serve as potential red flags for inadequate supervision. If a firm allowed unsuitable recommendations to persist despite these warning signs, investors may have a strong case for recovery.

Our lawyers are nationwide leaders in investment fraud cases.

Why You Should Consider Arbitration for Loss Recovery

Disputes between investors and brokerage firms are generally resolved through arbitration rather than traditional court litigation. This private process is often:

- Faster: Most cases resolve within 12 to 18 months.

- Individualized: Unlike a class action, each case is decided on its own specific facts, which can lead to larger individual recoveries.

- Binding: The decision of the neutral panel is final and enforceable.

If you believe you were misled or sold unsuitable products by Whipple, documenting your communications and account statements is a vital first step.

We Are The firm other lawyers

call for support.

How Meyer Wilson Werning Can Help

Meyer Wilson Werning represents investors nationwide who have suffered losses due to advisor misconduct, fraudulent misrepresentation, and supervisory failures. If you are concerned about your investments with Betsy Lou Whipple, Osaic Wealth, or Newbridge Securities, do not wait until deadlines pass to take action.

Contact us today for a free and confidential consultation to learn how we can assist you in protecting your financial interests.

Frequently Asked Questions

What specific investments are at the center of the complaints against Betsy Lou Whipple?

Recent complaints frequently involve alternative investments, with a specific focus on GWG L Bonds. These were high-risk debt instruments that became largely worthless following a bankruptcy filing by the issuer, despite allegedly being marketed to some clients as safe.

What were the results of the 2022 settlement involving Betsy Lou Whipple?

In July 2022, a customer dispute was settled for $250,000 following allegations of breach of contract, misrepresentation, and failure to supervise. The original claim had requested $500,000 in damages.

How does Regulation Best Interest (Reg BI) affect my case?

Reg BI requires that brokers and firms prioritize the client’s interests at the time a recommendation is made. If an advisor recommends a high-commission product that is not in the client’s best interest, it may constitute a violation of this federal rule, providing a basis for an arbitration claim.

Can I still file a claim if I am no longer working with Ms. Whipple?

Yes. Investors can often pursue claims against the firm where the alleged misconduct occurred (such as Newbridge Securities) even if the advisor has since moved to a new firm like Osaic Wealth.

Recovering Losses Caused by Investment Misconduct.