DAI Securities is a brokerage firm that warrants a thorough examination. This article explores their firm and their investment recommendations, fees, conflicts of interest, and regulatory challenges.

If you or someone you know has suffered significant investment losses working with DAI Securities or another brokerage firm, don’t hesitate to reach out to Meyer Wilson Werning today. Our attorneys are experienced in securities fraud cases and will help to guide you through the process with a free consultation to determine whether your losses are the result of actionable misconduct.

DAI Securities: Investment Recommendations and Impact

Overview of DAI Securities

Headquartered in Atlanta, Georgia, DAI Securities (CRD#: 36673) is a brokerage firm offering a variety of financial products and services, including stocks, bonds, U.S. government securities, mutual funds, alternative investments, and exchange-traded products. As an intermediary between investors and the financial markets, DAI Securities provides investment recommendations that can significantly influence financial decisions and outcomes.

DAI Securities and DAI Wealth: Understanding the Affiliation

DAI Wealth, also based in Atlanta, serves as the investment advisory arm of DAI Securities. This affiliation provides clients with access to both brokerage and advisory services, but it also raises concerns about potential conflicts of interest.

Investors should be mindful that DAI Securities’ recommendations could be influenced by its relationship with DAI Wealth. For example, if DAI Securities promotes a mutual fund managed by DAI Wealth, it may receive additional benefits such as higher commissions. This could lead to recommendations that are more financially beneficial to the firm rather than the investor.

We Have Recovered Over

$350 Million for Our Clients Nationwide.

Fees and Conflicts of Interest at DAI Securities

Insights from the Customer Relationship Overview

DAI Securities’ Customer Relationship Summary (Form CRS) reveals a complex fee structure, including potential hidden fees and commissions. Investors should be aware that the firm charges commissions ranging from 1-6% on transactions, with the exact percentage varying based on the product. Additionally, some investments, such as mutual funds, incur ongoing commissions in the form of 12b-1 fees, which persist as long as investors hold the investment.

Commissions and Incentives: How They Shape Investment Advice

DAI Securities’ commission structure may influence investment recommendations, leading to conflicts of interest. Key concerns include:

- The firm receives reimbursements from securities issuers for due diligence costs, potentially favoring investments that offer these reimbursements.

- Revenue-sharing agreements and third-party compensation arrangements can incentivize firms to recommend specific investments over others.

- Higher-commission products, such as variable life insurance and private placements, may be promoted over lower-cost alternatives, impacting investor returns.

Regulatory Challenges and Broker Misconduct

FINRA Actions and Their Implications

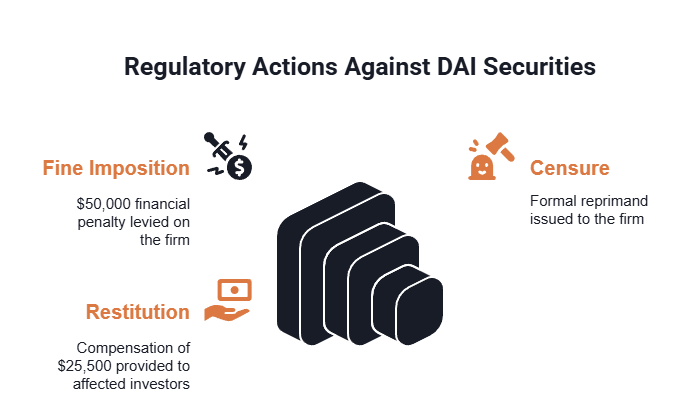

DAI Securities has faced regulatory scrutiny, particularly from the Financial Industry Regulatory Authority (FINRA). On April 10, 2024, FINRA took action against the firm for failing to disclose essential information to investors. The firm faced:

- A $50,000 fine

- Censure of the firm

- Partial restitution of $25,500 to affected investors

This case highlights concerns about transparency within brokerage firms.

Allegations of Broker Misconduct at DAI Securities

Several brokers associated with DAI Securities have faced misconduct allegations, raising concerns about the firm’s supervision and ethical practices. Common misconduct issues include unauthorized trading, misrepresentation of investment details, and negligence in due diligence when recommending investments.

These allegations reinforce the importance of investor awareness and scrutiny when working with brokerage firms. If you have concerns about unethical practices, reach out to us for assistance in protecting your investments.

Our lawyers are nationwide leaders in investment fraud cases.

How Meyer Wilson Werning Can Help

The history of DAI Securities highlights a complex landscape of investment recommendations, fees, conflicts of interest, and regulatory concerns. Key concerns with the firm include hidden fees and commissions, potential conflicts of interest due to affiliations and revenue-sharing agreements, and regulatory actions. Investors should carefully assess these factors and consider seeking independent financial advice.

If you or someone you know has been a victim of losses through DAI Securities, contact an Atlanta securities lawyer at Meyer Wilson Werning today. With over 20 years of experience and $350 million in recovered losses for our clients, we are well-versed in handling cases such as these.

We Are The firm other lawyers

call for support.

Frequently Asked Questions

What are alternative investments?

Alternative investments, such as private equity, hedge funds, real estate, and structured products, often come with higher risks, costs, and complexities compared to traditional investments. These assets tend to be less liquid, meaning investors may face difficulties selling them quickly at fair market value. They also often involve higher fees, including management and performance fees, which can erode returns over time.

What is variable life insurance?

Variable life insurance combines a death benefit with an investment component. Policyholders can invest in sub-accounts, offering growth potential but also market risk.

Recovering Losses Caused by Investment Misconduct.