If you are considering arbitration against a U.S.-based cryptocurrency exchange, it helps to understand the process you may go through. Arbitration is often required under user agreements and can be the only path to pursue recovery after unauthorized activity in your account.

If you’ve experienced losses due to crypto fraud on a trading platform, explore your legal options—our team at Meyer Wilson Werning can talk you through the steps of your case and help those who have been wronged. Reach out today to discuss your next steps with us.

What Arbitration Involves

Arbitration is different from going to court. It is designed to be a private, structured process where both sides present their cases before a neutral decision-maker. Some of the key features include

- A private forum: Cases are decided outside of the public court system.

- An appointed arbitrator: Instead of a judge, a neutral arbitrator reviews the case.

- A binding decision: The outcome is final and enforceable, with limited rights to appeal.

This structure is what makes arbitration the main venue for disputes with crypto exchanges.

We Have Recovered Over

$350 Million for Our Clients Nationwide.

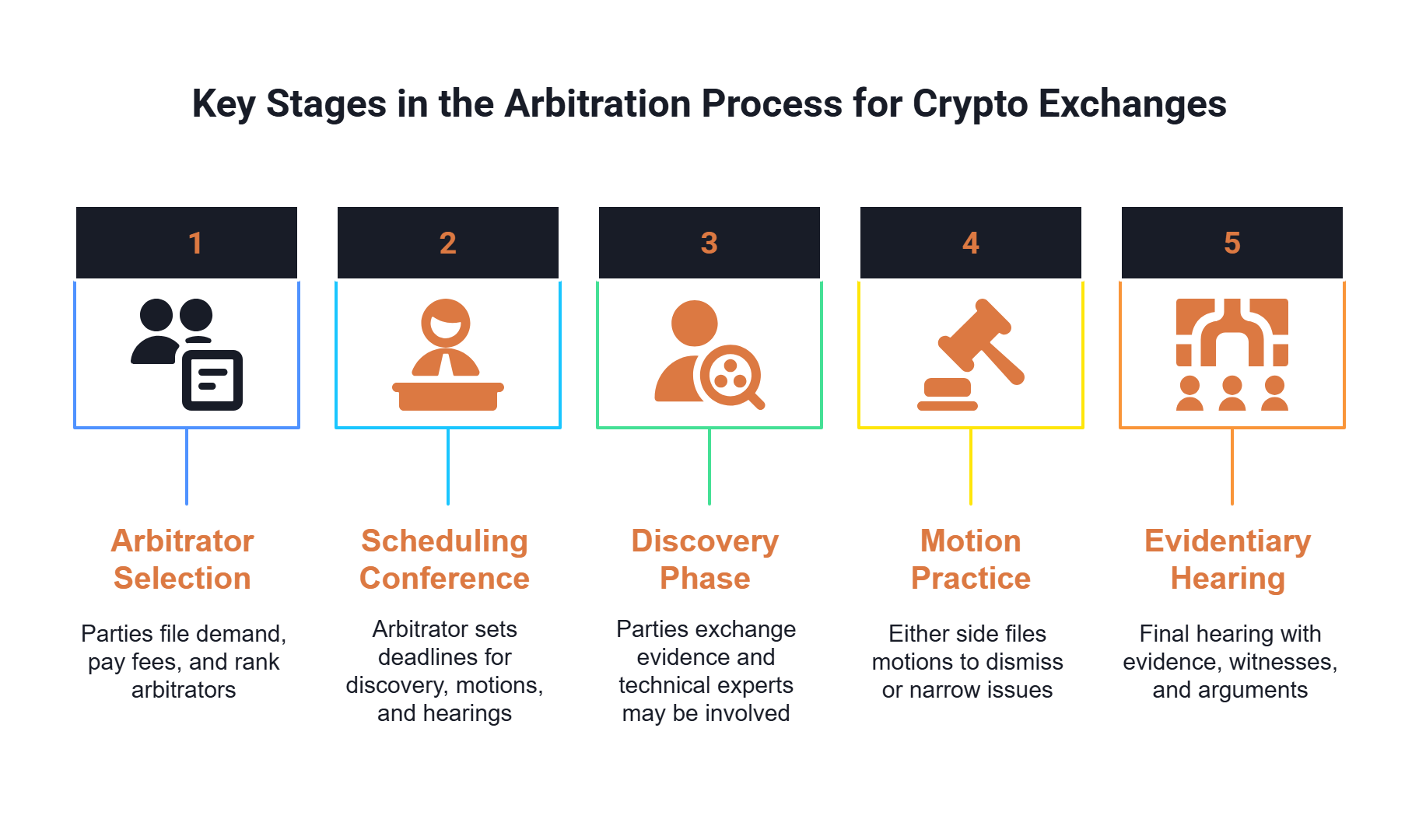

Key Stages in the Arbitration Process

While no two cases are identical, most arbitration claims against crypto exchanges follow a predictable path:

Filing and Arbitrator Selection

- File the arbitration demand with AAA or JAMS, as required by most crypto user agreements.

- Pay filing fees and await a proposed list of arbitrators.

- Both parties strike and rank arbitrators

Preliminary Conference and Scheduling

- Once the arbitrator is appointed, a scheduling conference is held

- Deadlines for discovery, motions, and hearings are set at this stage.

Discovery Phase

- Both sides exchange transaction records, security policies, logs, and other evidence.

- Technical experts, such as blockchain forensic analysts, may be involved.

- Disputes over evidence often require rulings by the arbitrator, causing further delays.

Motion Practice

- Either side can file motions to dismiss or narrow issues.

- This phase can take several months depending on how contested the motions are.

Evidentiary Hearing

- The final hearing involves presenting evidence, examining witnesses, and making arguments.

- Hearings in crypto theft cases often last several days.

- Scheduling conflicts or procedural disputes can push the hearing further out.

How Investors Can Prepare

Although arbitration is not fast, understanding the process helps set realistic expectations. Steps that can help include:

- Anticipating a 12–18 month timeline.

- Recognizing that expert evidence often plays a central role.

- Being aware that delays are common but can be challenged.

- Working with an experienced attorney to avoid procedural missteps and push back against unnecessary delays.

Our lawyers are nationwide leaders in investment fraud cases.

How Meyer Wilson Werning Helps Investors

If your cryptocurrency exchange denied liability for unauthorized transactions, arbitration may be your only path to recovery. At Meyer Wilson Werning, we represent investors nationwide in claims against financial institutions and crypto exchanges. Our team can guide you through the arbitration process, advocate for your rights, and help you pursue compensation for your losses. Contact us today to discuss your situation and explore your path forward.

We Are The firm other lawyers

call for support.

Frequently Asked Questions

How long does arbitration against a crypto exchange usually take?

Most arbitration cases take 12 to 18 months from the time you file until the final hearing. Delays are common due to backlogs, arbitrator selection disputes, and discovery disagreements.

Why does arbitration take so long?

The process involves multiple steps, including selecting arbitrators, exchanging evidence, ruling on motions, and scheduling hearings. Each stage can be slowed by conflicts, disputes, or procedural delays.

What are the main stages of arbitration?

Typical stages include filing the arbitration demand, arbitrator selection, a preliminary scheduling conference, discovery, motion practice, and finally, the evidentiary hearing. Each stage has its own timeline and potential challenges.

Recovering Losses Caused by Investment Misconduct.