Investors in the Bluerock Real Estate Fund are reporting steep losses, with many seeing declines averaging 20% of their initial investments. These losses are linked to issues such as restricted liquidity, mass redemptions, and questions about whether financial advisors fully explained the risks. Between January and May 2025 alone, investors pulled more than $760 million from Bluerock funds.

If you’ve been pressured into making an investment you didn’t fully understand such as a real estate fund or REIT, you’re not alone—the securities fraud lawyers at Meyer Wilson Werning can help. Reach out today to discuss your next steps with us.

Understanding Bluerock Real Estate Investments

Bluerock has built its reputation on alternative real estate products marketed as steady, income-focused opportunities. Its lineup includes:

- Bluerock Residential Growth REIT (BRG): A multifamily housing REIT.

- Bluerock Total Income+ Real Estate Fund (TI+): An interval fund with limited redemption options.

- Bluerock Value Exchange (BVEX): Sponsor of 1031 exchanges and DST investments.

These products were often sold as conservative investments, but in reality they involved high fees, limited liquidity, and exposure to speculative real estate risks.

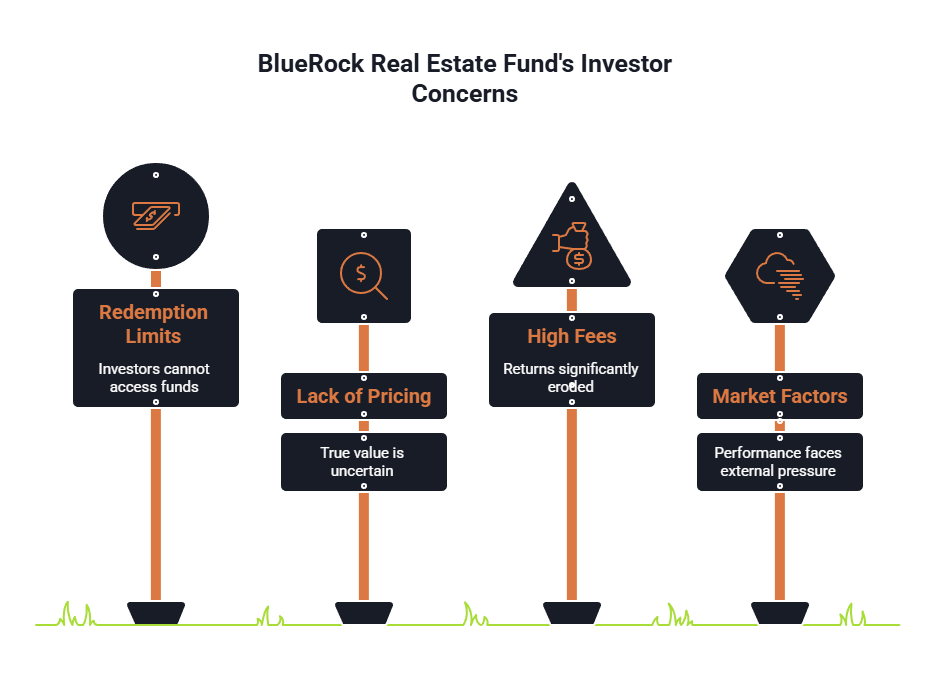

Why Investors Are Concerned

Bluerock funds combined multiple challenges that have now come to the surface:

- Redemption limits left investors unable to access their money when needed.

- Lack of daily pricing created uncertainty around the true value of shares.

- Commissions of 7–10% and annual fees significantly eroded returns.

- Market factors such as rising interest rates and tenant defaults put additional pressure on performance.

The gap between how these funds were marketed and how they performed is at the heart of current investor dissatisfaction.

We Have Recovered Over

$350 Million for Our Clients Nationwide.

July 2025: The Latest Developments and New Listing

In July 2025, Bluerock announced plans to list the Total Income+ Real Estate Fund on the New York Stock Exchange. The move was framed as an attempt to increase liquidity, but for investors it introduces new risks:

- Once shares begin trading publicly, they may sell for less than their net asset value (NAV).

- Continued loss of confidence could accelerate sell-offs, pushing prices even lower.

- Listing plans highlight the extent of financial stress facing the fund after $760 million in redemptions earlier in the year.

For many investors, this development has confirmed concerns about whether they were ever given an accurate picture of the risks involved.

The Risks of Bluerock Funds

Despite being presented as income-generating and resilient, Bluerock products carry risks that make them unsuitable for many retail investors.

Key Risks Investors Faced

- Valuation uncertainty: Without daily pricing, investors often don’t know the real value of their holdings.

- Performance risk: These products are still tied to the real estate market and vulnerable to downturns.

- High commissions and fees: Upfront costs of 7–10% plus annual fees created conflicts of interest for brokers.

- Illiquidity: Interval funds only permit redemptions quarterly; non-traded REITs and DSTs can lock up funds for years.

Understanding these risks is essential in assessing whether brokers made recommendations that were truly suitable.

Our lawyers are nationwide leaders in investment fraud cases.

Broker Duties and Regulatory Standards

Brokers are governed by FINRA Rule 2111 and Regulation Best Interest, which require them to ensure recommendations are appropriate for a client’s financial goals and risk tolerance. This includes:

- Performing due diligence to understand the product.

- Ensuring the recommendation fits the client’s profile.

- Avoiding overconcentration in risky assets.

- Providing full disclosure of fees, liquidity restrictions, and the potential for loss.

When brokers prioritize commissions over client interests, investors can pursue claims for recovery.

To learn more about Regulation Best Interest (Reg-BI) standards, watch our video below:

We Are The firm other lawyers

call for support.

Who May Have a Claim Against Their Advisor?

You may have a potential claim if any of the following apply:

- You are a retiree or conservative investor.

- You were told Bluerock products were safe or guaranteed.

- A large portion of your portfolio was invested in Bluerock.

- You were unable to redeem your investment when needed.

- You suffered significant financial losses.

These scenarios can strengthen a case for compensation through arbitration.

Arbitration as a Path to Recovery

Arbitration offers a private and often faster alternative to litigation. Investors can pursue claims such as:

- Unsuitable investment recommendations.

- Misrepresentations or omissions of risk.

- Overconcentration in alternative real estate.

- Failure to conduct adequate due diligence.

Most arbitration cases resolve within 12–18 months, making this process a practical option for many investors.

How Meyer Wilson Werning Helps Bluerock Investors

The recent wave of losses and the July 2025 developments show how investors were left vulnerable to unsuitable recommendations in complex real estate products. At Meyer Wilson Werning, we represent clients who were misled or inadequately warned about risks tied to investments like the Bluerock Real Estate Fund. If you suffered losses, we can help you explore your options for recovery through arbitration and other legal avenues. Contact us today to discuss your situation and explore your path forward.

Frequently Asked Questions

Why are investors in the Bluerock Real Estate Fund reporting losses?

Many investors have seen losses averaging 20% due to redemption limits, high fees, and declining real estate performance. More than $760 million was pulled from Bluerock funds in early 2025.

What risks are tied to Bluerock’s real estate products?

Bluerock funds carry risks such as illiquidity, valuation uncertainty, high commissions, and exposure to real estate downturns. These issues make them unsuitable for conservative investors.

What happened in July 2025 with the Bluerock Total Income+ Fund?

Bluerock announced plans to list the Total Income+ Fund on the NYSE, aiming to boost liquidity. However, shares may trade below net asset value, adding new risks for investors.

Can brokers be held liable for recommending Bluerock funds?

Yes. Brokers must ensure investments are suitable and disclose risks, fees, and liquidity limits. Failing to do so can expose them to liability for investor losses.

How can investors recover money lost in Bluerock investments?

Investors may pursue arbitration claims for unsuitable recommendations, misrepresentations, or broker conflicts of interest. Arbitration typically resolves in 12–18 months and can lead to compensation.

Recovering Losses Caused by Investment Misconduct.