In the chaotic aftermath of a crypto exchange failure or data breach, investors are often left wondering where to turn. The world of cryptocurrency can feel like the Wild West, but the principles of investor protection are timeless. Holding large financial institutions accountable for negligence is a battle we have been fighting—and winning—for decades.

This is where Meyer Wilson Werning stands apart. We are not newcomers chasing a trend; we are a veteran firm applying our deep, battle-tested expertise to a digital battleground. If your crypto account was hacked for a significant amount of losses, reach out today to start walking through the process together.

The Arena is Arbitration, Not the Courthouse

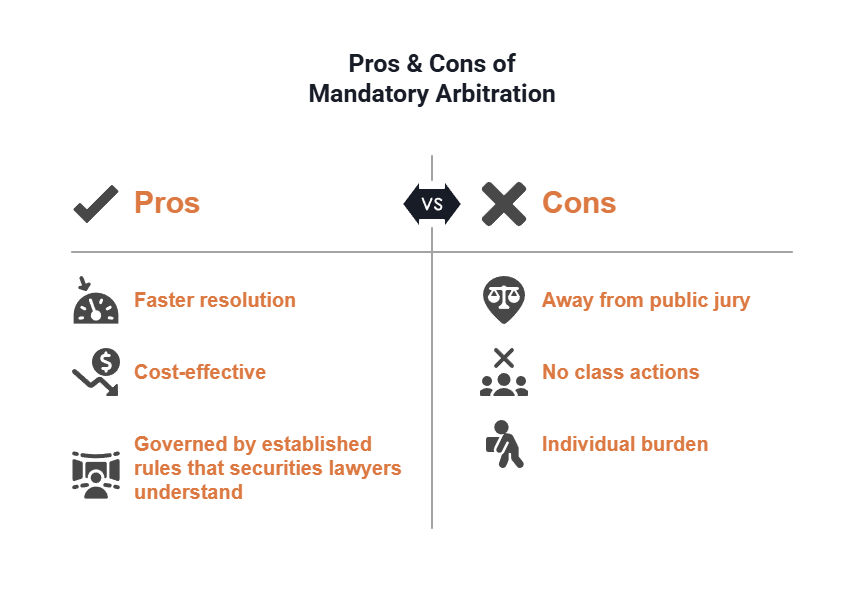

The first thing every crypto investor must understand is that exchanges like Coinbase have effectively closed the courthouse doors. Your user agreement likely contains a mandatory arbitration clause, which dictates the legal battlefield.

Coinbase’s Mandatory Arbitration Clause

Buried in the fine print of the lengthy agreement you signed is likely a clause that has profound consequences for your claim. It means:

-

You cannot file a traditional lawsuit in a public court.

-

You are barred from joining a class-action lawsuit.

-

You must pursue your claim individually through a private, binding arbitration process, often in forums like JAMS or the American Arbitration Association (AAA).

For most users who miss the narrow 30-day opt-out window, private arbitration is likely to be the only available path to recovery.

A Familiar Battlefield for Our Firm

This legal framework—forcing individual disputes into a private arbitration forum—is not new. It is the exact model that has dominated the traditional securities industry for decades. For years, we have resolved investor claims against Wall Street brokerage firms through the Financial Industry Regulatory Authority (FINRA) arbitration system. The procedures, legal arguments, and strategies in a Coinbase arbitration claim are fundamentally the same.

We Have Recovered Over

$350 Million for Our Clients Nationwide.

The Decisive Advantage: Mastery of the Arbitration Process

In this environment, a lawyer’s deep, practical knowledge of the arbitration process is far more valuable than a superficial understanding of blockchain technology. Winning requires mastering a unique set of skills that we have honed over a quarter of a century.

It’s Not About Blockchain, It’s About the Law

A crypto exchange, in its role as a custodian of your assets, has a fundamental duty to protect you. The Coinbase breach, rooted in employee misconduct and a glaring lack of internal controls, is a classic “failure to supervise” case. This is a type of claim Meyer Wilson Werning has successfully litigated thousands of times. We aren’t learning a new area of law; we are applying our profound, existing expertise to a new class of assets.

Turning Their Strategy Against Them

By forcing disputes into private arbitration, exchanges hope for a more controlled, private legal process away from public jury trials. In doing so, they inadvertently level the playing field. The battle becomes a focused, evidence-based contest governed by specific procedural rules. This transforms the dispute into precisely the type of fight that our elite securities arbitration lawyers are uniquely equipped to win.

A Synergy of Strengths: The Meyer Wilson Werning Team

Our firm is built on a partnership that creates a legal force with unmatched depth and capability. It is a synergy of foundational wisdom and modern, specialized execution.

David P. Meyer: The Architect of Investor Justice

Managing Principal David P. Meyer is a nationally recognized titan in investor protection. His career was launched by a landmark $261 million class-action jury verdict against Prudential Securities that recovered 100% of losses for over 200 retirees. The author of the #1 Amazon Bestseller, The Investor Protector, David has established the firm’s unshakeable foundation of fighting for the individual investor against the biggest financial firms in the world.

Courtney M. Werning: The Master of Modern Arbitration

Principal Courtney M. Werning is the firm’s razor-sharp edge in the modern legal arena. She has dedicated her entire practice to mastering the arbitration forums where these cases are won. Her expertise is so deep that she serves on FINRA’s National Arbitration and Mediation Committee—the very body that helps shape the rules for these disputes. This provides our clients with an unparalleled, insider’s understanding of the process. Her essential role was recognized in 2025 when the firm was officially renamed Meyer Wilson Werning.

Our lawyers are nationwide leaders in investment fraud cases.

Take Control of Your Crypto Recovery

When an exchange fails in its duty to protect you, you are not helpless. A proven legal path to recovery exists. Our firm offers an unmatched combination of strengths:

-

A Proven Track Record: Over $350 million recovered for more than 1,500 investors.

-

Unparalleled Expertise: The foundational experience of David P. Meyer combined with the modern arbitration mastery of Courtney M. Werning.

-

A Client-First Model: A nationwide practice that operates on a contingency-fee basis, meaning there is no financial risk to you.

If you have suffered substantial losses due to security failures at a cryptocurrency exchange, do not wait. Statutes of limitations can bar your claim if you delay. Contact Meyer Wilson Werning today for a free, confidential consultation and take control of your recovery.

We Are The firm other lawyers

call for support.

Frequently Asked Questions

Why can’t I file a lawsuit against Coinbase in court?

Coinbase, like many crypto exchanges, includes a mandatory arbitration clause in its user agreement. This clause typically prevents you from filing a lawsuit or joining a class action and instead requires you to resolve disputes through private arbitration.

What is arbitration and how does it work?

Arbitration is a private legal process where a neutral third party reviews evidence and makes a binding decision. It’s typically faster and more streamlined than court litigation, and the process is governed by rules set by organizations like JAMS or the AAA.

Is arbitration a disadvantage for investors?

Not necessarily. While it limits some legal options, arbitration can actually level the playing field—especially when handled by experienced securities attorneys who know how to navigate the process effectively.

Why is Meyer Wilson Werning uniquely suited for crypto arbitration?

Our firm has over 20 years of experience handling investor disputes in arbitration forums. We bring deep knowledge of financial misconduct claims and a winning track record in forums like FINRA—skills directly transferable to crypto exchange cases.

Do I have to pay anything to pursue a claim with Meyer Wilson Werning?

No. We work on a contingency fee basis, meaning you pay nothing upfront. We only get paid if we successfully recover money for you.

Recovering Losses Caused by Investment Misconduct.