Brian Kennedy, a registered broker and investment adviser based out of Pennsylvania, has faced numerous customer disputes and regulatory concerns. With 10 customer complaints and a termination, Kennedy’s track record raises serious concerns about whether additional investors may have suffered financial harm due to his actions.

If you or someone you know has been impacted by Brian Kennedy or another broker, don’t hesitate to reach out to Meyer Wilson Werning today. Our attorneys are experienced in broker misconduct cases and will help to guide you through the process with a free consultation.

Who Is Brian Kennedy? A History of Customer Disputes

Brian Kennedy (CRD#: 2321416) is currently registered with Cambridge Investment Research, Inc., but has previously worked at several brokerage firms, including Lincoln Financial Advisors Corporation and Concourse Financial Group Securities. His record includes multiple settled customer disputes and several pending disputes. Below are key disclosures from his history:

Ongoing Customer Disputes

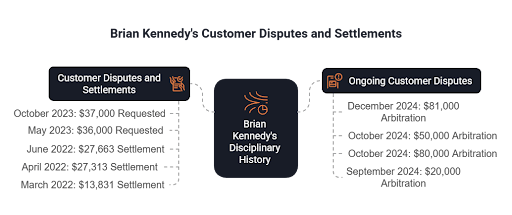

- December 2024: Two claimants filed a combined pending $81,000 arbitration alleging unsuitable oil and gas investments.

- October 2024: A separate $50,000 arbitration remains pending for alleged unsuitable oil and gas investments.

- October 2024: A pending $80,000 arbitration involving similar allegations.

- September 2024: Another pending $20,000 arbitration regarding investment suitability concerns around oil and gas investments.

Customer Disputes and Settlements

- October 2023: Allegations of unsuitable oil and gas investments. The claim requested $37,000 and settled.

- May 2023: Another oil and gas investment dispute requesting $36,000 that settled.

- June 2022: A customer alleged unsuitable oil and gas investments, resulting in a settlement of $27,663.

- April 2022: Another dispute over unsuitable oil and gas investments settled for $27,313.

- March 2022: Allegations of unsuitable oil and gas investments resulted in a settlement of $13,831.

Employment Termination

- 2018: Kennedy was terminated by Lincoln Financial Advisors for violating firm policies regarding insurance products. The firm alleged that Kennedy continued to service non-securities insurance policies through associates after his appointment with the insurance carrier was terminated.

Kennedy’s pattern of disputes and terminations suggests potential suitability violations and compliance concerns, raising red flags for investors.

We Have Recovered Over

$350 Million for Our Clients Nationwide.

Brian Kennedy’s Tenure at Lincoln Financial Advisors

A significant portion of Kennedy’s career was spent at Lincoln Financial Advisors Corporation (2010-2018), where some of his customer disputes originated. Lincoln Financial Advisors has faced regulatory scrutiny and customer complaints for its handling of alternative investments and supervision practices.

Concerns About Lincoln Financial Advisors

- Multiple arbitration cases involving oil and gas investments.

- Regulatory fines related to failures in supervision and compliance.

- Recurrent allegations of unsuitable investment recommendations.

Given these compliance concerns, investors who worked with Kennedy at Lincoln Financial should carefully review their accounts for potential misconduct.

Meyer Wilson Werning: Fighting for Investors Harmed by Brian Kennedy

Brian Kennedy’s long history of customer disputes, pending arbitrations, and regulatory concerns raises serious questions about the suitability of his investment recommendations. If you or someone you know suffered losses due to Kennedy’s investment strategies or financial advice, you may be entitled to compensation.

If you or someone you know has suffered losses due to the actions of brokers like Brian Kennedy, the experienced attorneys at Meyer Wilson Werning are here to help. With more than 20 years in the industry and over $350 million recovered for our clients, our focus on investment fraud and securities litigation has helped many investors recover their losses. Contact us today for a free consultation to discuss your case and learn how we can assist you in protecting your financial interests.

Recovering Losses Caused by Investment Misconduct.