The Securities and Exchange Commission (SEC) has recently intensified its enforcement of recordkeeping regulations, placing further scrutiny on the financial sector. In a sweeping SEC recordkeeping enforcement action, the SEC has collected over $63 million in fines from 12 financial services firms for recordkeeping violations related to the use of personal devices for work communications. This article explores the details of this enforcement, its implications for the financial sector, including the scrutiny of financial practices, and what it means for regulatory compliance moving forward.

SEC’s Recordkeeping Enforcement: A Closer Look

Collection of Over $63 Million in Fines

The recent SEC recordkeeping enforcement action has resulted in over $63 million in fines collected from 12 firms in the financial sector, highlighting the SEC’s commitment to enforcing financial regulations and recordkeeping rules. This substantial penalty underscores the seriousness with which the SEC views recordkeeping violations and the importance of regulatory compliance in financial services firms. The fines act as a warning to the entire industry about the importance of maintaining proper records of all business communications and adhering to data retention laws.

Targeting Firms Using Personal Devices

The SEC’s focus on personal devices for work communications arises from the risks they pose to recordkeeping integrity, data privacy, and compliance with financial regulations. When employees use personal smartphones, tablets, or messaging apps for business purposes, firms cannot properly monitor, record, and retain those communications, leading to potential non-compliance with data retention laws.

For example, if a financial advisor uses a personal WhatsApp account to discuss investment strategies or sensitive deals with clients, those messages may not be captured in the company’s records, potentially violating SEC rules and risking penalties. If that financial advisor discusses a sensitive deal with a client via WhatsApp without proper oversight. This conversation could be lost or deliberately hidden, potentially leading to several outcomes, such as:

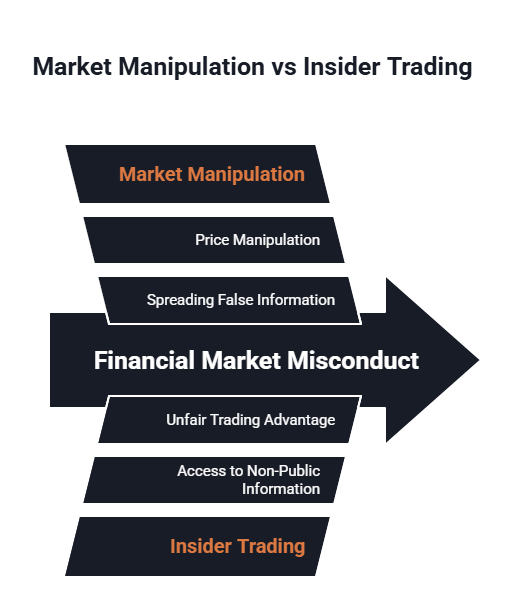

- Market manipulation: This practice involves actions that interfere with the fair and efficient operation of financial markets, such as spreading false information to influence a stock’s price.

- Insider trading: This occurs when someone with access to non-public, material information uses it to gain an unfair advantage in trading securities.

Both practices are illegal because they undermine investor confidence and the integrity of the markets. If a trader discusses confidential deals through unmonitored personal communications, it undermines financial institutions’ recordkeeping, and regulators may be unable to detect illicit activities, posing a significant risk to the financial system. The SEC’s emphasis on personal devices is an attempt to close this loophole and ensure that all business-related communications are properly documented and accessible for regulatory review, thereby enhancing investor protection and market integrity.

We Have Recovered Over

$350 Million for Our Clients Nationwide.

High-Profile Cases: Blackstone, Charles Schwab, and More

Case Study: Blackstone Inc.

Blackstone Inc.’s personal devices usage for business communications led to significant compliance challenges. As a result, they were subject to a $12 million fine across three of their subsidiaries. The SEC mandates that financial firms keep detailed records of all communications related to their business activities, including emails, text messages, and other electronic communications, in accordance with recordkeeping rules and data retention laws.

If Blackstone were to execute a large deal on a personal device, this would not only subject Blackstone to penalties but also impedes the SEC’s ability to oversee the firm’s activities, compromising investor protection and market integrity.

Case Study: Charles Schwab Corp.

The consequences for Charles Schwab Corp. extend beyond monetary fines for recordkeeping violations. They include:

- Reputational damage

- Increased scrutiny of financial practices

- Need for substantial investments in regulatory compliance

Without proper oversight and archiving of their communications, the company could be exposed to further regulatory risks and potential customer disputes.

Regulatory Compliance and Firms Involved

Tighter Oversight in the Financial Sector

This increased regulatory scrutiny is aimed to compel financial institutions to take action, such as:

- Reevaluate their compliance infrastructure

- Invest in new technologies for data retention

- Foster a culture of regulatory compliance and awareness among employees

This includes understanding the importance of transparent communication from financial advisors and ensuring that all interactions are properly documented.

Firms Involved in the Recent SEC Enforcement

In the latest recordkeeping enforcement from the SEC, 12 firms were caught violating SEC regulations. These firms include:

- Advisors LLC

- Blackstone Inc.

- Carlyle Group Inc.

- Charles Schwab Corp.

- Davis Polk

- JPMorgan Chase & Co.

- KKR & Co.

- Ropes & Gray

- Santander Holdings USA Inc.

- TPG Capital LP

The involvement of high-profile companies like Blackstone and Charles Schwab underscores the far-reaching implications of this enforcement action. This crackdown on the use of personal devices for business communications sends a clear message about the importance of comprehensive recordkeeping practices.

Our lawyers are nationwide leaders in investment fraud cases.

Conclusion

The recent SEC recordkeeping enforcement of $63 million in fines against these 12 financial institutions emphasizes the importance of adhering to recordkeeping rules and financial regulations. As the financial industry grapples with these challenges, firms must adapt their policies, invest in robust compliance technologies, and foster a culture of regulatory adherence. If you’re seeking to protect your investments and require legal assistance in managing these complex regulatory landscapes, reach out to us at Meyer Wilson Werning for a consultation and explore how we can help you achieve a favorable outcome.

We Are The firm other lawyers

call for support.

Frequently Asked Questions

What are recordkeeping violations?

Recordkeeping violations occur when financial firms fail to maintain, store, or provide access to required business records and communications as specified by recordkeeping rules. These can include:

- Not archiving emails

- Not retaining trade tickets

- Allowing personal device use without oversight

Such violations undermine regulatory transparency and can lead to fines and reputational damage.

Why are personal devices for financial advisors a concern?

Personal devices pose risks to business communications and data security, making it hard to monitor and retain communications as required by regulators, potentially jeopardizing data privacy and market integrity. They can create blind spots for insider trading or market manipulation and often lack robust security measures. Regulators emphasize comprehensive policies to ensure compliance and protect sensitive information.

What are data retention laws?

Data retention laws require organizations to securely store specific data types for set periods. In finance, this includes preserving business communications and transaction details for regulatory inspections and misconduct investigations. Compliance involves robust systems for data capture, storage, and retrieval, with significant investments in technology and infrastructure.

Recovering Losses Caused by Investment Misconduct.